No Roadmap For Tomorrow

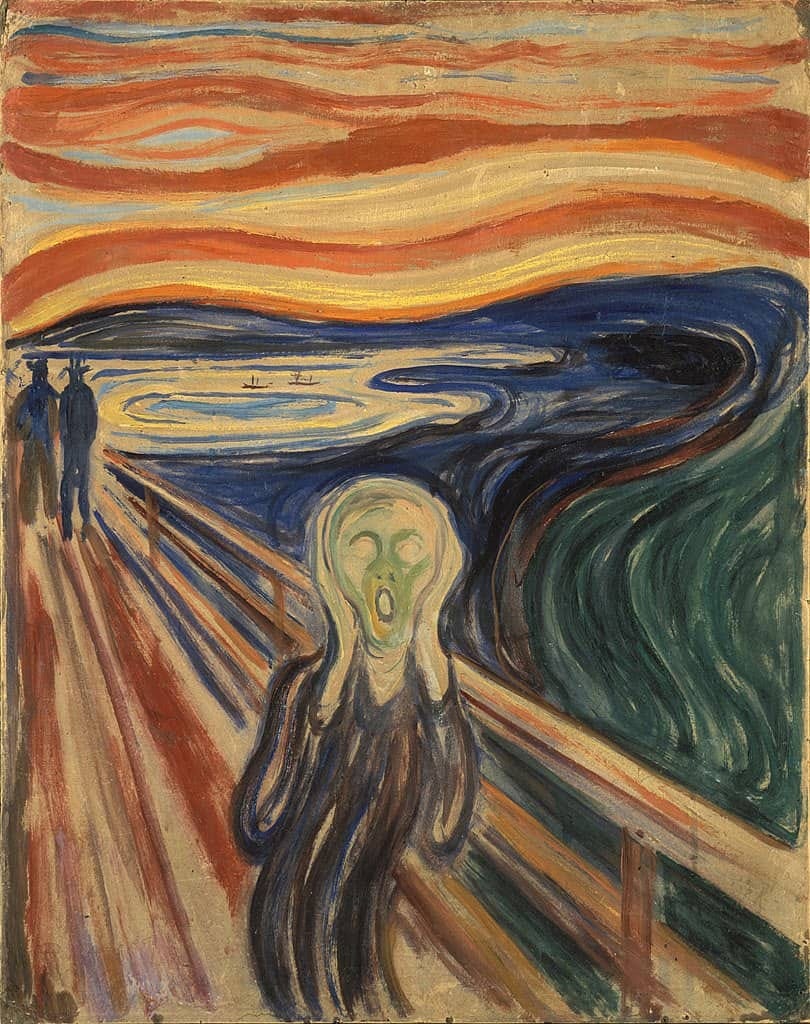

A generation on the edge of collapse, carrying debt, doubt and the burden of broken promises.

The future we didn’t choose

Imagine growing up in the early 2000s, a time when everything was almost perfect. A time of significant cultural developments, of better music, better entertainment. Imagine witnessing the start and rise of the Internet and the booming of a relatively stable economy. When we wouldn’t have to worry much about the future and would get to enjoy the present more.

We’ve all grown up hearing the likes of “study hard so you can get a good job and future.” That could’ve been true, because it was something that worked for our parents. But we can all agree on one thing: the world has changed and we no longer have as many opportunities as we were once told.

Today’s inflation is higher than it’s ever been, and keeps on getting higher by the second. People are living paycheck to paycheck. Jobs are scarce. AI has begun to replace work that humans once did. Rent is skyrocketing, making the housing crisis a living nightmare. And urging the government to care and do something—say, about the climate—is almost like asking negligent parents for attention.

Is this the future we were told to “prepare and work for”? Is this the system we were told to trust? How are we supposed to trust something that leaves us at a disadvantage when we need it most?

There is a clear credibility crisis that mirrors the credit crisis. The youth don’t believe the future is secure—because it’s not.

So the important questions we need to ask are:

Can you build a future on a foundation of false promises?

What will happen to us when the system collapses and we have nothing to rely on?

Inherited debt, earned doubt

Are we the first generation to pay more for less?

Statistics from 2011 to 2024 show that student loan debt in the USA totals to $1.777 trillion. Borrowers who pursue higher education are likely to have higher balances; the higher you go up the academic ladder, the more exorbitant student loans become. The situation is exacerbated by federal loans, with average debts ranging from $20, 340 to $102, 790.

And have you noticed how the system we’re supposed to trust tends to reward those with generational wealth but punish the rest of us? The US payment system has turned cash registers into machines of economic inequality. If you or your relatives have been pretty well financially, you can qualify for an elite credit card—rewards, flier miles, cashback per shopping. But if you or your family receives average or below average income, you can still qualify for that card but minus the rewards. You ought to rely on your debit card at all times.

It’s worthy to mention that our generation is also facing the risk of growing on an almost inhabitable planet. A survey published by Lancet Planetary Health in 2021 states that 60% of people aged between 16 and 25 describe themselves as very worried about the climate, and nearly half of them admit this anxiety affects their daily functioning. We can thus notice a pattern of facts culminating in a pattern of worries; how the older generations once dreamed of building a world of limitless opportunity, but in their ambition to grow, industrialize, and profit, left behind something less inspiring: a landscape of debt, inequality, and crisis. In the name of progress, they mortgaged the future—and we’re the ones stuck paying the bill.

Yet we are expected to move on as if nothing has happened. We’re expected to make it in a broken system while having to listen to these same older generations constantly criticize us and make demands. “Just work harder,” they say. “You should’ve studied more,” they criticize. “Why haven’t you moved out yet?” they ask. “When will you start a family and settle?” they continue asking.

And asking, and asking.

No credit, no credibility

How do you gain credibility in a system that doesn’t see you?

People struggle to build credit in different ways, and that ends up backfiring by building more debt. Your parents may suggest getting a credit card and spending, building a credit score. But even being able to own a credit card can be difficult, as they’ll ask for credit history, and there you have a loophole: no credit card without credit and not being able to build credit without a credit card. An irony.

Nowadays, it’s almost impossible to afford housing. A lack of government funding, and low income in comparison to housing costs are some of the reasons. Since the pandemic, property prices have increased over the years. For example, rent in Dubai rose by 20% in 2023, forcing many to move to cheaper areas or smaller apartments. Construction companies now focus on luxurious buildings, making it even harder to find affordable housing. We can also find these problems in bustling cities such as New Delhi, New York, and Seoul, where demand outweighs supply, driving costs up the wall.

In recent years, young graduates have voiced that their wages are not keeping up with market trends, leaving them with fewer savings. The data likely indicates that graduates have more than you think, but they’re actually financially worse than they were in the 1980s.

In 1984, before taxes the average graduate had an equivalent of $55,706 remaining from their median earning of $68,342. However, by 2020 graduates had remaining $49,817 from their median earning of $64,085. There might be an explanation for why new graduates have less and less remaining every year: there has been a fall of $3,502 (5.12%) in median pay after inflation, since 1984, while housing has increased by 35.77% from $5,939 per person, to $6,911 in 2022.

And as if that’s not enough, older generations—particularly boomers—are now questioning Gen Z’s work ethic. Often being branded as ‘lazy’ or as giving ‘minimal effort,’ the older generations fail to realize that our hard work is not yielding any results. We burn out academically and professionally, only to crawl back to our parents for a roof over our heads.

Gen Z has resorted to finding new forms of work—bitcoin, freelancing, content creation, investment, entrepreneurship, etc. The value of traditional work has changed. Our generation looks forward to flexible hours. We wish to adapt to these changes in our careers as the time goes. And we’re shamed for it.

We have begun to seriously question the value of traditional success—degrees, full-time jobs, home ownership. This is not out of laziness or pure rebellion, but because the math doesn’t add up. Boomers were given support and funds—low-cost education, rising wages, accessible mortgages—while Gen Z is met with skepticism and gatekeeping. We are asked to prove ourselves at every stage (think unpaid internships and endless credentialing side hustles), while all we’re asking is for enough to pay rent. And even then the reward is instability. Why has the deal changed for us?

The price of trust

If trust is currency, are we bankrupt?

In 2025, trust is a scarce commodity; it’s the one thing that had for long been the invisible currency that sustained democracies and communities. It is now perceived as a form of luxury that not many people can afford. According to the 2025 Edelman Trust Barometer, 61% of people globally have a moderate or high sense of grievance, while the global index funds also remains stagnant at 56%, indicating the public’s confidence in higher institutions like the government, media, and businesses.

The gap between the public’s expectations and the governmental actions contribute to a growing sense of disillusionment. According to the Barometer, a higher portion of the world’s population believes that leaders across multiple sectors are intentionally misleading them. 69% worry that the government leaders disseminate false or exaggerated information. 68% express similar concerns about business leaders and 70% are apprehensive about journalists and reporters.

Now the spending momentum has decreased and banks are being affected by this, specifically because of ‘protectionist policies’ such as tariffs. Despite the current resilience, underlying factors like records of household debt totaling $18.04 trillion and the resumption of student loan repayments pose a significant threat to the economy's stability. All of this is suggested by surveys that show only 63% of Americans express confidence in their banks, while a majority expresses some or little confidence.

Misinformation is furthermore exacerbating the erosion of trust. We live in a world where disinformation is more powerful than information. It has led to pervasive threats, resulting in short term global risks such as wildfires, floods, hurricanes, and other natural disasters that can create lasting economic and social damage. Simultaneously, government initiatives to counter falsehood have been scaled back. Government bodies that once focused on combating disinformation, such as NBC, CBS, and CNN, are being gutted by the current Trump administration. And with the progression of tech platforms and AI, the distribution of disinformation online is increasing.

Generation IOU

Are we the lost generation— or the first to find another way?

Maybe not all of us grew up loving school and learning new things, but for the ones who did, we loved the idea of expanding our knowledge and preparing for a better future. Some of us were raised to believe in the promise of learning—education was the path to success. But the world has revolutionized in a short span of time. And the older we get, the more cracks we see in the illusion of education.

We are now sacrificing ourselves. Not only for credentials but for a future that we have no knowledge of. The dream of pursuing a career remains a dream. Apart from paying mind-numbing prices to access higher education, many universities offer degrees that rarely lead to actual jobs because it's not about success—it's about prestige, pride and profit.

Now our dreams dissolve in real time: careers we were told to prepare for don't exist anymore, or pay poor wages. A job will require a master's degree. Three years of experience and three side hustles just to cover rent. And yet we are told to be grateful. Grateful to be educated. Grateful to participate. Grateful to have the things we do. But how can we be grateful to a system that crushed our hope and gave us debt in return?

This is where we drew the line. We started this so-called rebellion.

Generation IOU isn’t just disappointed—we are daily redesigning and shaping the old systems. The old career system—corporate loyalty, homeownership, full-time jobs—won't let us in, forcing us to take matters into our own hands. You want to be negligent? Let us show you what negligence is. We have become freelancers like Tina Roth and Paul Jarvis, founders such as Paul Allen and Mark Zuckerberg, content creators like Markiplier, and formed cooperatives. We are community organizers and climate activists, artists, and analysts. Not because we are scattered, but rather much because we are responding to instability with creativity. Refusing the myth of a 9-5 office job with worse toxic traits than my ex, and the dream of a white picket-fence life.

Our rebellion is not laziness. It’s resilience. It is choosing ourselves and reimagining our future, our worth, and ownership on our terms. Because how do you plan to commit to a future that you can’t picture yourself in? Take a new picture. Take a new white canvas to shape up to your future.

We took matters into our own hands when you decided to ignore us. We started to shape what it feels to be secure, how we will inherit a world out of the debt you left us. In a system that won't fail others when they need them. A place where we reclaim our lives and create new narratives.

Maybe one day you will understand that this is the beginning of a new era of something better for us, for our future kids, for the future.

What now? Maybe everything, maybe nothing. But it will be ours to write.

Sources

https://www.self.inc/info/graduate-salaries-compared-to-living-costs/

https://stylus.com/consumer-attitudes/edelman-trust-barometer-2025-consumers-negative-outlooks

https://www.axios.com/2025/04/22/fact-checking-misinformation-disinformation

https://www.reddit.com/r/GradSchool/comments/1js8atr/disillusioned_with_higher_education/?rdt=39259

https://www.investopedia.com/a-paradigm-shift-in-consumer-culture-1171173

Credits

Written by: Ashley de Abreu; First revision by: Roshni Ray; Final revision by: Heba El Hallak (Editorial Director)

A truly daunting yet relevant read!